The data show that the supply of industrial park land in the South still fails to meet demand, while the occup...

The data show that the supply of industrial park land in the South still fails to meet demand, while the occupancy rate of industrial parks remains high, so that land rents continue their upward trend.

Southern industrial park land rental prices continue to maintain their momentum in Q3/2023.

Southern industrial park land rental prices continue to maintain their momentum in Q3/2023.

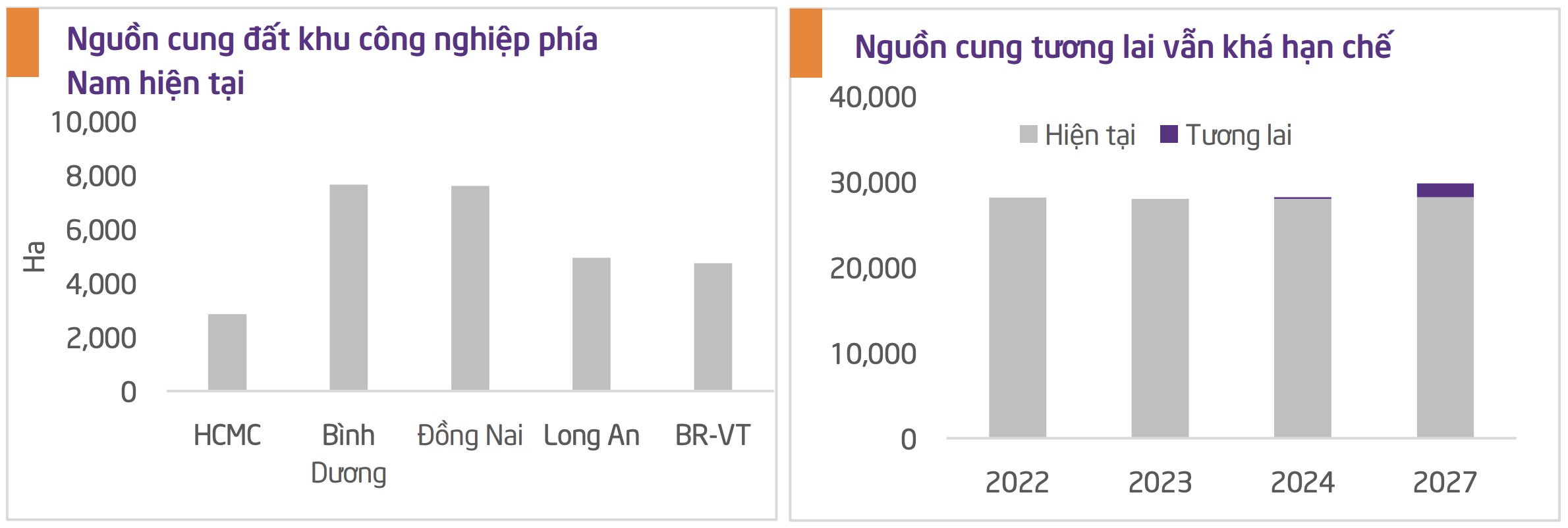

The latest data show that the supply of industrial park land in the southern region is still in a state of «stress» while in the third quarter of 2023, there will be only 171 hectares of new land from the Nam Tan Tap (Long An) industrial park.

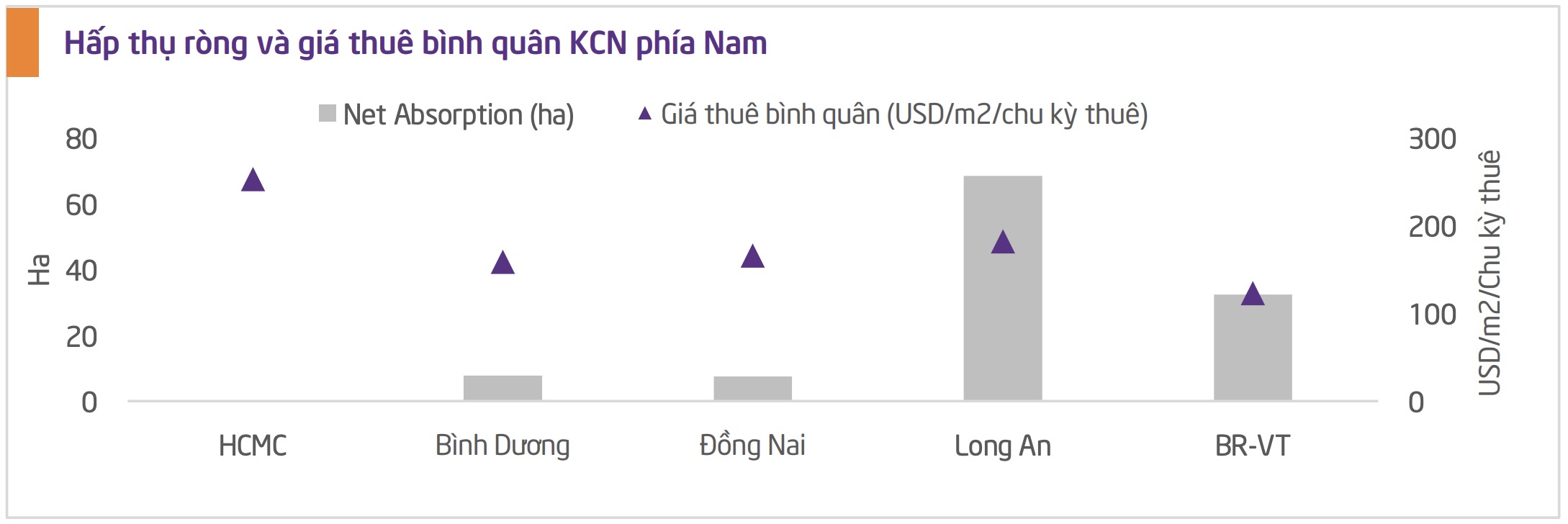

The above factors help the rental price of industrial park land in the South to maintain upward momentum. According to real estate services company Cushman & Wakefield, the primary rental price of industrial land in Q3 2023 will reach USD 167/m2/rental cycle, up 1% from Q2 2023 and up to 8.5% from Q3 2022.

The rental price of industrial park land in the South in Q3/2023 continues to increase by 1% compared to Q2/2023. (Source: TPS Research, Cushman & Wakefield)

The rental price of industrial park land in the South in Q3/2023 continues to increase by 1% compared to Q2/2023. (Source: TPS Research, Cushman & Wakefield)

The recovery in manufacturing and transportation was the main driver of net absorption in this segment. However, the rental prices of these two types in Q3 2023 will remain stable compared to Q2 2023. Specifically, the rental price of ready-to-use warehouses reaches USD 4.4/m2/month and ready-to-use factories reach USD 4.7/m2/month.

According to a recent assessment by TPS Research, the supply of industrial land in 2024 in the southern region is still at a “fairly limited” level and continues to be in a state of stress. It is estimated that only about 216 hectares of new industrial land will be marketed next year, concentrated mainly in the province of Long An

Supply of industrial park land in the South is expected to remain “fairly limited” in the near future. (Source: TPS Research, Cushman & Wakefield)

Supply of industrial park land in the South is expected to remain “fairly limited” in the near future. (Source: TPS Research, Cushman & Wakefield)

By 2027, the market is expected to have about 1,600 hectares of new offerings, concentrated in notable projects such as the Cay Truong Industrial Park (about 505 hectares) and the Nam Tan Uyen Industrial Park (about 245 hectares).

Given the above market conditions, TPS Research believes that Phuoc Hoa Rubber Joint Stock Company (stock code PHR - HoSE) will be the most direct and significant beneficiary of the increase in rental prices of industrial park land and strong rental demand.

In particular, at the end of the month of 05/2023, the People’s Committee of the Binh Duong Province decided to authorize the joint stock company of the Nam Tan Uyen Industrial Park (stock exchange code NTC) lease land to implement the Nam Tan Uyen Industrial Park Expansion Project (Phase 2) of 346 hectares in Binh Duong Province. Currently, Phuoc Hoa Rubber owns 33% of the capital of the Nam Tan Uyen Industrial Park.

Via Tap chi Cong thuong