In tandem with the positive developments in the stock market in June, the shares of SBT (Thanh Thanh Cong Corp...

In tandem with the positive developments in the stock market in June, the shares of SBT (Thanh Thanh Cong Corporation - Bien Hoa, TTC AgriS) have become favored by foreign investors, steadily increasing their ownership percentage.

By the end of June 2023, the VN-Index rose by 45.01 points, equivalent to 4.19%, reaching 1,120.18 points. The average trading value per session was 17,000 billion VND, a 39.7% increase compared to the previous month and a 77% increase compared to five months ago. Simultaneously, foreign investors ceased massive selling, with a net sale of approximately 364 billion VND in June 2023 on the Ho Chi Minh Stock Exchange (HoSE). In terms of matched orders, there was a net purchase of 368 billion VND.

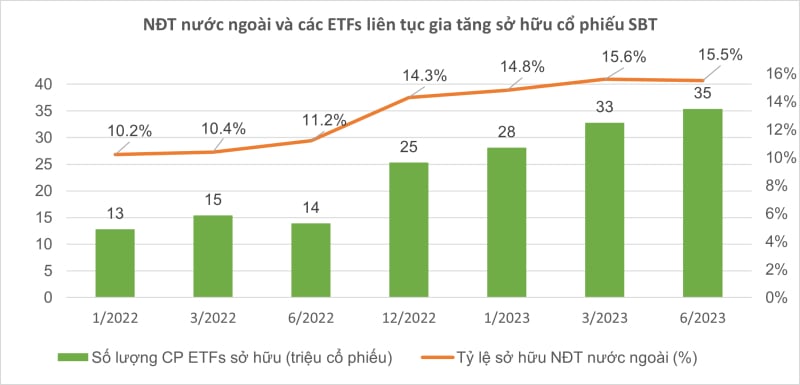

Contributing to the positive market trend, the shares of SBT from Thanh Thanh Cong Corporation - Bien Hoa (TTC AgriS, HoSE: SBT) continue to be attractive to numerous foreign organizations and investors, who consistently increase their ownership percentage. As of June 30, 2023, the foreign ownership ratio in TTC AgriS has shown robust growth, currently standing at approximately 16%, a 42% increase compared to the same period in 2022.

Additionally, reputable domestic and international ETFs have demonstrated interest by increasing their investments in these shares. Vietnam's stock market currently has 7 ETFs with a scale exceeding 100 million USD, including Fubon FTSE Vietnam ETF, DCVFM VNDiamond ETF, iShares MSCI Frontier and Select EM ETF, VNM ETF, DCVFM VN30 ETF, FTSE Vietnam ETF, and SSIAM VNFinLead ETF. Among these, 3 out of 7 ETFs holding SBT shares are Fubon FTSE Vietnam ETF with approximately 19 million shares, Vaneck Vietnam ETF with around 9 million shares, and iShares MSCI Frontier and Select EM ETF with about 3 million shares.

As of June 30, 2023, the total SBT shares held by these ETFs amount to over 35 million shares, a 154% increase compared to the same period in 2022. Notably, Fubon FTSE Vietnam ETF has consistently increased its ownership percentage, from around 4 million to approximately 19 million shares, representing a more than 390% increase compared to the same period in 2021 and a more than 230% increase compared to the same period in 2022.

This indicates that capital is flowing into essential manufacturing sectors with positive business results and growth prospects, especially companies that meet strict selection standards, have a well-established management framework, and pursue sustainable development strategies, such as TTC AgriS.

Building a sustainable agricultural foundation, aiming for Green values, is a prerequisite for TTC AgriS to attract foreign capital.

To successfully attract and mobilize foreign capital over the past period, TTC AgriS has continually strived to improve its management framework to meet stringent standards, particularly those from international financial institutions. This not only involves maintaining the company's reputation and strong financial capability, transparently disclosing figures audited by international organizations, having feasible capital utilization plans, and engaging professional advisory units but also ensuring that the capital serves sustainable development projects and meets ESG standards.

At the opening of the TTC AgriS Innovation Day 2023, Dang Huynh Uc My, Vice Chairman of the Board of Directors of TTC AgriS, emphasized the commitment to sustainable development.

It is worth noting that in the 2021-2022 period, SBT has consecutively been part of the "Top 20 Listed Companies in the VNSI Sustainable Development Index" for five years, with an ESG score of 96%. SBT continues to maintain its position as the only Sugar Company listed in the VNSI20 Index - Top 20 stocks with the highest sustainable development scores in the stock market.

In 2023, TTC AgriS marks a significant milestone in transitioning from a traditional agricultural management model to an integrated smart agricultural economy - market-oriented, product-oriented, promoting agricultural economic thinking instead of pure production thinking.

On June 16, 2023, TTC AgriS successfully organized the TTC AgriS Innovation Day 2023 with the theme "Serving the best natural nutrition for body needs," officially launching the series of events starting from 2023. This pioneering initiative leads the way in sustainable agricultural development, creating a common ground for science and technology in agriculture.

Through the fruitful outcomes achieved from efforts over the years, TTC AgriS aims to continue leading future agricultural trends by focusing on developing organic material regions, diversifying the crop value chain to make the most of raw materials and minimize by-products. The company aims to achieve Net Zero by 2035. The "green" business strategy is considered the driving force for TTC AgriS to maximize profits, contribute to local economic development, and share success with stakeholders, promoting the construction of a sustainable Vietnamese agricultural economy.

Via Business Youth Magazine