SBT recorded strong growth in Q1 profit, completing 35% of the year plan.

SBT recorded strong growth in Q1 profit, completing 35% of the year plan.

Thanh Thanh Cong - Bien Hoa Joint Stock Company (SBT) has just announced its consolidated financial statements for the first quarter of the crop year 2021-2022 (the period from July 1, 2021, to September 30, 2021). Net revenue reached 4,312 billion VND, up to 18% over the same period. Sugar still plays a key role in revenue structure when Sugar Product Lines recorded VND 4,123 billion, accounting for nearly 96%.

Revenue from financial activities reached 346 billion VND, up nearly 5 times over the same period, of which the majority came from sugar trading activities on the international commodity exchange. During this time, SBT has successfully entered the world commodity market through the "Trading house" - An international commodity trader. As a result, the Company can be proactive in balancing the "balance of goods" with competitive output and raw material costs, ensuring a reasonable amount of inventory, thereby minimizing fluctuations in price.

As a result, pre-tax profit reached 262 billion VND, up to 96%, completed 35% of the year plan. Profit after tax reached 195 billion VND, nearly 2 times over the same period.

SBT's total assets as of September 30, 2021, increased to 21,491 billion VND, up to 5% compared to the beginning of the period. In which, the value of inventory was recorded at 3,121 billion VND, and the value of short-term receivables was 7,282 billion VND. SBT's equity increased slightly compared to the beginning of the period, to 8,486 billion VND.

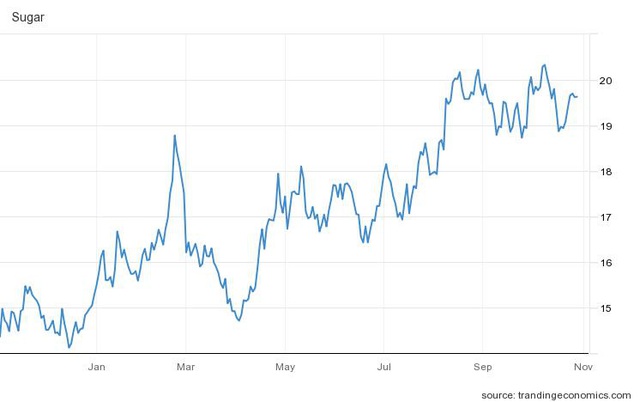

In the first quarter of the 2021-2022 financial year, world sugar prices increased from 17 US cents to approximately 20 US cents, the highest level since 2017 due to unfavorable weather conditions in Brazil (the world's largest sugar producer). In the second half of July, sugar production in the South-Central region of Brazil is estimated to decrease by 11%. Accordingly, ISO believes that in the crop year 2021-2022, the world sugar market will have a deficit of more than 3.8 million tons due to the influence of major sugar-producing countries in the world.

The sugar prices are currently at a 4-year high.

The sugar prices are currently at a 4-year high.

With the domestic sugar market, since the beginning of this year, the Government has imposed anti-dumping and anti-subsidy taxes on Thai sugar, thereby creating favorable conditions for sugar producers and farmers to grow sugar. domestic sugarcane.

In the 2021-2022 FISCAL year, SBT sets a target of 16,905 billion VND in revenue, up 13% over the same period and 750 billion VND in pre-tax profit. The company's management board expects production output to grow by over 20%, besides continuing to promote the development of raw material areas in Vietnam, Cambodia, and Laos by 10,000 - 20,000 hectares, focusing on organic material areas. SBT's sugarcane material area is about 66,000 hectares.

According to Mrs. Dang Huynh Uc My - Vice Chairman of the Board of Directors of SBT: “The company is developing the raw material area in Laos so that it can aim to produce 100,000 tons of organic sugar per year when the demand is at the commodity exchanges. The current organic sugarcane area of SBT is more than 6,000 hectares, aiming at 14,000 hectares in the FISCAL year 2025-2026”.

TTC Bien Hoa's Organic sugarcane area in Attapeu province, LAOS

SBT is currently pursuing a strategy of developing organic sugar products, which is a prominent global trend. Especially, after the COVID-19 pandemic, consumers are more concerned about their health.

At the annual general meeting of shareholders held on October 20, 2021, SBT approved a plan to issue shares at the rate of 20% to professional securities investors in order to have financial resources. for an ambitious business plan for the next five years. Mrs. Dang Huynh Uc My said that the capital raising plan is receiving many positive signals from investors and is expected to be completed in 6 - 9 months.

Regarding the profit distribution plan for 2020 - 2021, SBT will pay a cash dividend at the rate of 7%, equivalent to an amount of 462 billion VND.

Via CafeF.