Given the recent sharp rise in world sugar prices and the impact of trade remedies that reduce competitive pre...

Given the recent sharp rise in world sugar prices and the impact of trade remedies that reduce competitive pressure from cheap imported sugar, domestic sugar prices are expected to remain high this year, bringing a positive outlook for sugar producers.

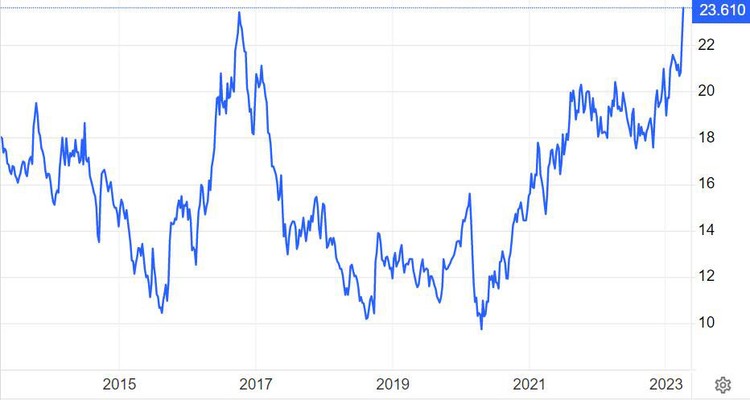

The price of raw sugar on the world market has exploded since the end of March 2023 until today

Sugar prices hit their highest level since October 2016

According to Trading Economics, the rise in raw sugar prices has been supported by the prospect of strong demand and tight global supply. Specifically, a nearly 20% increase in crude oil prices between late March and early April 2023 is expected to encourage cane sugar producers to allocate their production to more cost-effective biofuel blends.

In its agricultural sector report for the beginning of April 2023, VNDirect Securities JSC said that global sugar prices in the first half of 2023 will be supported by lower-than-expected sugar production in India; adverse weather conditions (drought) have a negative impact on sugar production in Europe; It is expected that Brazilian sugar producers will continue to prioritize ethanol production over sugar due to the recent increase in gasoline prices.

Indeed, in the country, the imposition of anti-circumvention duties on trade remedy measures for certain cane sugar products imported from 5 ASEAN countries (Indonesia, Malaysia, Cambodia, Laos, Myanmar) since August 2022 in order to prevent origin fraud and evasion of anti-dumping duties for cane sugar originating in Thailand is assessed as having a more pronounced impact on the markets in 2023.

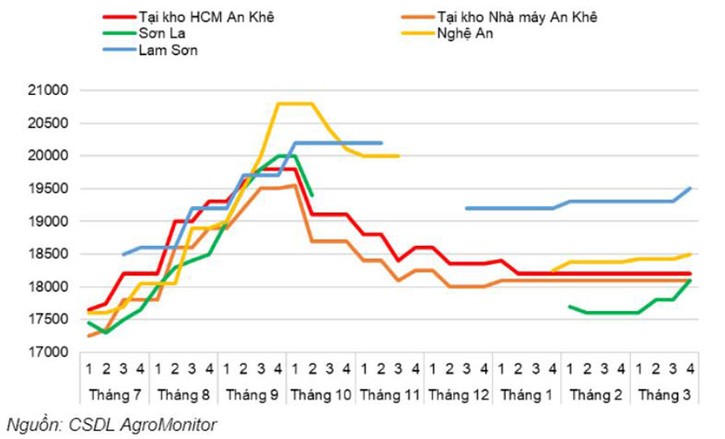

Selected Mill Sugar Prices by Week from July 1, 2022 to March 30, 2023

Selected Mill Sugar Prices by Week from July 1, 2022 to March 30, 2023

However, the sugar segment also plays an important role in supporting the production and trade of Quang Ngai Road's Vinasoy brand soy milk products.

Given the upward trend in world sugar prices and the positive impact of trade remedies that reduce competitive pressure from cheap imported sugar, domestic sugar prices are expected to remain high this year, bringing a "sweet season" to sugar producers.

At Thanh Thanh Cong - Bien Hoa Sugar Joint Stock Company (TTC Agris) - the enterprise with the largest production scale in the sugar industry today, although pre-tax profit in the first half of the fiscal year decreased by 25.5%. Compared to the same period last year, but with the main business being sugar, TTC Agris still recorded a growth of 13.1% in revenue, reaching 11,360.5 billion VND and 1,158.5 billion VND in gross profit, an increase of 8 .7%. The decrease in profit was mainly due to the impact of financial activities.

In recent years, increasing debt investment to increase capacity and expand raw material areas has caused TTC Agris' debt to continuously increase in both value and proportion in the capital structure. As of December 31, 2022, the Company's outstanding debt is VND 11,541.1 billion with 80% being short-term debt. The debt ratio in the capital structure is 39.7%. High debt causes interest to account for a significant proportion of the Company's cost structure and affects profits. With interest rates tending to cool down while sugar prices continue to increase strongly, profit results in the second half of the fiscal year of TTC Agris are expected to be more positive.