The attractiveness of industrial real estate attracts significant cash flows from mergers and acquisitions.

The attractiveness of industrial real estate attracts significant cash flows from mergers and acquisitions.

In the first nine months of 2023, tenants from China, Japan, the United States and the EU are investors actively seeking industrial land and warehouses in the Vietnamese market. Photo credit: Quy Hoa

In the first nine months of 2023, tenants from China, Japan, the United States and the EU are investors actively seeking industrial land and warehouses in the Vietnamese market. Photo credit: Quy Hoa

According to a recent report by CBRE Vietnam, the southern and northern markets registered 450,000 m2 and 752,000 m2 of new warehouses respectively in the first nine months of the year. We see that the southern logistics market is entering the last months of the year with positive signs of recovery in demand. In particular, the newly signed leases are a continuation of the expansion of existing manufacturers, 3PL (logistics service providers) and e-commerce.

Imprint of trends in production evolution

Notably, in the first nine months of 2023, tenants from China, Japan, the United States and the EU are investors actively seeking industrial land and warehouses in the Vietnamese market, Representing approximately 70-80% of the number of applications to CBRE Vietnam in the South and North. In particular, the dominant trend that continues in recent years is that large Chinese solar companies are increasing their production in Vietnam, not only to enter the South Asian market-Is, but also to serve as a springboard to more easily enter the European and American markets.

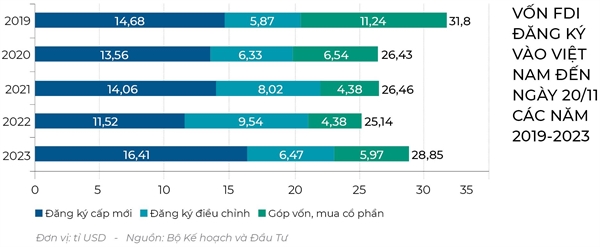

The figures above show that industrial real estate is the brightest point in the context of the Vietnamese real estate market at a completely quiet stage. In 2023, alongside the wave of shifting the global manufacturing supply chain to competitive production centers in Southeast Asia, Vietnam’s industrial parks will continuously increase their supply. According to statistics, this year 397 industrial parks were created with a total area of 122,900 hectares.

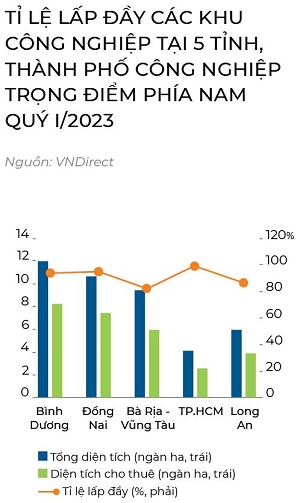

The survey shows that only Long An and Ba Ria - Vung Tau have many empty premises for rent and that the market urgently needs new offers in Binh Duong, Dong Nai, Long An ... CBRE predicts that over the next two years, rental prices of industrial land in Vietnam are expected to increase by 6-10% per year in the North and South. Positive demand comes from many industrial groups and nationalities, which helps drive up rents in many localities. At the same time, the rental price of ready-to-use warehouses is expected to increase slightly from 2 to 4% / year over the next 2 years.

Accelerate your presence with mergers and acquisitions

The industrial real estate market has seen exceptional mergers and acquisitions, such as ESR Group Limited which spent $450 million to increase its stake in BW Industrial Development Joint Stock Company (BW Industrial). Previously, Frasers Property Vietnam (FPV) had announced a cooperation with the Gelex group to deploy industrial parks in the North, with a total investment of about USD 250 million in the first phase. Or the acquisition by Hon Hai Precision of a project land in the industrial park of Guangzhou for 60 million dollars; Phat Dat Real acquired 31.8% of the shares of Phat Dat Industrial for a transaction value of 27 million USD..

Cushman & Wakefield anticipates that a large amount of capital from foreign investors will flow into the Vietnamese real estate market during the period 2024-2026, many transactions are being negotiated and very active.

S&P Global released its “Big Picture: M&A Outlook 2024” report which shows that while global M&A activity has slowed for most of 2023, Many potential factors are pushing negotiators to rebound next year due to domestic and foreign factors. In particular, Vietnamese industry will benefit from numerous free trade agreements (FTAs), creating a diversified investment base and increasing investment in manufacturing and industrial real estate.

Transactions have multiplied because over the years, Vietnam has positioned itself as a promising destination to become a manufacturing center in the region. Photo credit: kinhbaccity.vn

Transactions have multiplied because over the years, Vietnam has positioned itself as a promising destination to become a manufacturing center in the region. Photo credit: kinhbaccity.vn

However, many experts have estimated that industrial real estate in Vietnam still has many challenges to solve. Transport infrastructure is developing rapidly, but development has not yet reached the rate of economic and social growth. In addition, by focusing on attracting high value-added industries and increasing productivity to be on par with other countries in the region, demand for skilled labour will increase, but Vietnam has not been able to keep up.

Via Nhip cau dau tu