At the beginning of 2024, investors poured over $600 billion into global bond funds, taking advantage of the highest yields in decades. This has led to 2024 being dubbed the “Year of Bonds.”

Keeping pace with the trend, Saigon Thuong Tin Real Estate JSC (TTC Land, HoSE: SCR) has recently announced a plan to issue bonds for collaboration in investing in a key project.

As inflation decreases, central banks have been able to lower interest rates, driving investments in bonds. In stark contrast to 2022, when $250 billion was withdrawn from bond funds, 2024 has seen strong growth. According to EPFR, as of mid-December 2024, approximately $617 billion had been invested in developed and emerging market bond funds, surpassing the $500 billion recorded in 2021 and potentially making 2024 a record-breaking year.

Aiming to Develop Vietnam's Bond Market

In recent years, Vietnam's bond market, particularly government bonds, has become an essential channel for capital mobilization for the government, policy banks, and enterprises. It is also a safe and efficient investment method.

According to the Ministry of Finance, the strategy for developing the securities market aims to increase bond market debt to at least 58% of GDP by 2030. To meet the capital needs for national key projects, many domestic enterprises have quickly joined the bond issuance wave.

Domestic Enterprises Race to Issue Bonds

VietJet Aviation JSC (VJC) and Asia Commercial Bank (ACB) have announced plans to raise billions of VND through bond issuances. Similarly, major real estate companies such as Vinhomes JSC have swiftly participated in this trend.

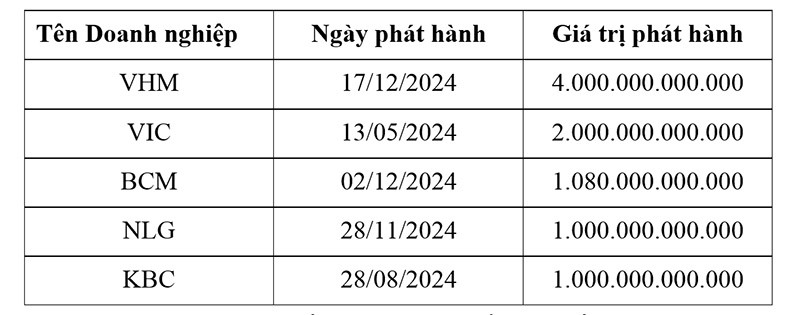

Value of Bond Issuances by Prominent Real Estate Companies by Market Capitalization (Source: HNX, Vietcap, Unit: VND Billion)

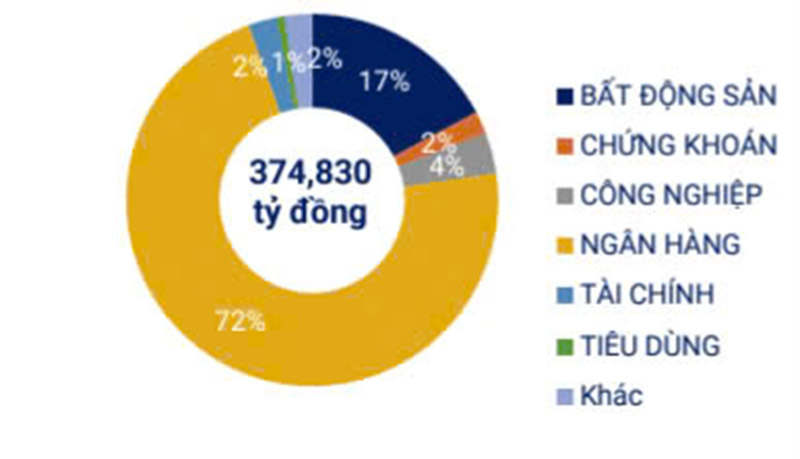

According to the Vietnam Bond Market Association (VBMA), as of November 2024, Vietnamese businesses had issued nearly VND 375 trillion in bonds, of which VND 343 trillion were privately placed bonds. The banking sector accounted for 72% of the issuance value, while the real estate sector made up 17%.

TTC Land Joins the Trend, Issuing Bonds for a Key Project in Phu Quoc

Phu Quoc City, also known as the "Pearl Island," is one of Vietnam's top tourist destinations. With its rich natural resources, strategic location, and development policies, Phu Quoc holds significant economic development potential, particularly in tourism, resort real estate, and international trade.

According to experts, Vietnam's resort real estate market, particularly in Phu Quoc, is expected to grow strongly over the next 2–3 years due to several factors: the recovery of domestic and international tourism; Phu Quoc is expected to welcome nearly 6 million visitors in 2024, surpassing the pre-COVID-19 level of 5.1 million; favorable policies and infrastructure development, aiming to become a Grade-I city by 2025; and increasing demand for second homes and resort real estate. Moreover, Phu Quoc benefits from long-term value appreciation due to limited land supply and growing demand.

Market forecasts predict a turning point for Phu Quoc's resort real estate market in Q2 2025. Products such as land plots and project villas are expected to draw significant investor interest. Policies like 30-day visa exemptions for tourists will further boost tourism and drive the resort real estate market in Phu Quoc.

Seizing this potential, TTC Land has announced its plan to issue bonds to collaborate with Toan Hai Van Corporation in developing the Vinh Dam Complex project. The project, with a total investment of VND 3,579 billion, features a resort complex combined with tourism and accommodation services in Phu Quoc.

Strategic Investment for Diversification

The bond issuance, valued at VND 850 billion, has a term of 60 months with a par value of VND 100 million per bond. These non-convertible, non-warranted bonds are secured by a payment guarantee from Orient Commercial Bank (OCB), ensuring investor safety and early redemption rights.

The bonds offer an initial interest rate of 8.5% with a favorable 3.6% margin for adjustment periods and a five-year term—longer than the three-year term common among industry peers. The project is expected to generate high returns, serving as a strategic step to increase revenue, enhance market position, and elevate TTC Land's stock value and brand reputation.

In addition to successfully increasing its capital from VND 3,957 billion to VND 4,306 billion through debt-to-equity swaps, TTC Land has implemented a stringent liquidity strategy, divesting inefficient assets and portfolios to create resources. The bond issuance for the key resort real estate project in Phu Quoc marks a critical step in the company’s land portfolio diversification plan.

Currently, beyond its 163 hectares of residential land in Ho Chi Minh City and southern provinces, TTC Land is expanding its industrial land portfolio under its 2026–2030 strategy. The company's focus on developing reasonably priced resort products in Phu Quoc over the next 2–3 years reflects its clear vision for future growth.

With the potential of the resort real estate market from 2025 to 2027, TTC Land has chosen Phu Quoc as its strategic focus, specifically the Vinh Dam Complex project in collaboration with Toan Hai Van Corporation. This is considered a forward-looking strategy to optimize investment value in the resort real estate sector.

Via Investment Newspaper