Industrial parks are considered to have promising prospects and growth potential in the context of general dif...

Industrial parks are considered to have promising prospects and growth potential in the context of general difficulties in the real estate market.

In the report "2024 Debt Market Outlook - Adapting to Change," FiinRatings believes that the prospects of Vietnam's industrial real estate sector will continue to be maintained at a stable level through three factors: (1) High demand due to the expansion of production by both FDI enterprises and domestic enterprises; (2) the supply encouraged by the Government to meet increasing demand; and (3) promotion of investment in infrastructure.

In particular, the wave of production chain shifting and diversification from China is expected to continue to drive investment demand from foreign businesses, thereby further enhancing the efficiency of the entire industry.

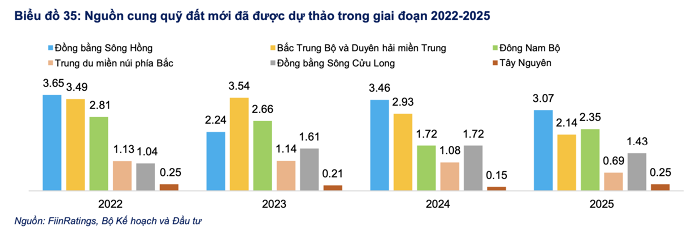

The supply of industrial land in Vietnam is expected to increase by an additional 44,760 hectares in the period 2022 - 2025 to meet the rapidly increasing demand for industrial land in Vietnam. The new supply is accelerating expansion in the Red River Delta, North Central region, and Central coastal areas.

"The slow approval of policies for industrial real estate in Vietnam is a timing issue when many cities have proposed expanding new land funds for industrial parks," FiinRatings noted.

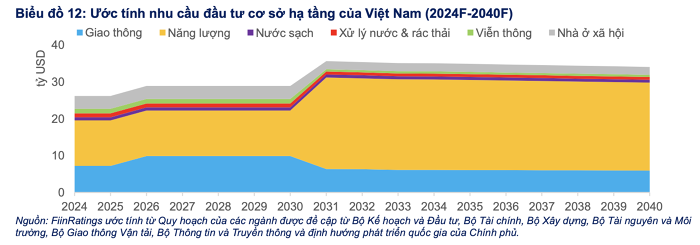

According to FiinRatings estimates, Vietnam needs at least $25 - $30 billion annually to invest in infrastructure over the next 10 years, equivalent to nearly $600 billion by 2040. The government aims to increase private sector participation to alleviate pressure on the budget. Although this is the main driving force for growth, there are still significant constraints on sustainable development, most notably the scarcity of long-term financial resources.

Currently, commercial banks play a crucial role as the main source of funding, but the allocation of loans for infrastructure is still relatively modest, typically ranging from 5% to 7% of total outstanding loans at each bank.

In the next phase, the State Bank of Vietnam has imposed restrictions on the short-term capital ratio for medium and long-term loans, which may further reduce allocation to infrastructure.

On the other hand, Vietnam's corporate bond market is still in a nascent stage of development, with the market size relatively small, accounting for only 9.75% of the country's GDP. This reflects limitations in financial tools for other financial institutions, such as insurance companies, to participate more actively and become stable sources of funding for infrastructure development.

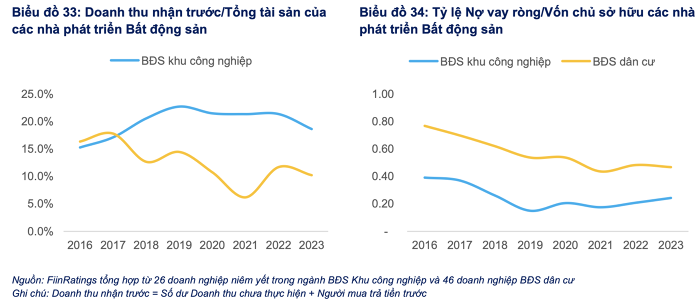

In the context of various fluctuations as in the period 2021-2023, industrial park developers still demonstrate stable business capabilities by continuing to attract foreign investment, reflected in positive occupancy rates.

With a business model that allows industrial park developers to receive large deposits from customers at the early stages of the project and receive full infrastructure rent payments for a leasing period (up to 50 years), the expert group evaluates the financial leverage ratio that this group uses for investment is usually lower than that of residential real estate developers, leading to lower financial risk assessments.

Via Vietnambiz