In recent times, despite the real estate market's sluggishness, the industrial real estate segment remains vib...

In recent times, despite the real estate market's sluggishness, the industrial real estate segment remains vibrant and is always considered a bright spot thanks to FDI inflows. However, this "rich land" still faces many difficulties and challenges due to the competitive pressure from other countries in the region.

Opportunities

During the period from 2022 to 2025, many key transportation infrastructure investment projects, connecting provinces, cities, and economic regions, have been approved and quickly commenced, creating strong economic growth momentum. Focus is placed on developing road infrastructure: completing the North Ring Road 4, Ho Chi Minh City Ring Road 3, North-South expressway, Ben Luc - Long Thanh expressway.

Additionally, many waterway transport routes connecting industrial parks to seaports and major logistics centers, such as Cat Lai port and Cai Mep - Thi Vai port, will be invested in the near future.

Moreover, elevating comprehensive strategic partnerships with the US will boost attracting high-tech investment. Each year, US businesses invest about 200 - 300 billion USD abroad, but recent FDI from the US to Vietnam has only been around 1 billion USD per year.

After enhancing cooperation with the US, it is expected that FDI from the US will be invested in high technology in Vietnam, as our country possesses large reserves of rare earth and tungsten.

According to the "Exploration, Exploitation, Processing, and Utilization of Mineral Resources Plan for the period 2021-2030, vision to 2050", Vietnam is the world's second-largest holder of rare earth reserves (estimated at about 22 million tons). The 2022 announcement by the US Geological Survey states that Vietnam's tungsten reserves are about 100 thousand tons, ranking third in the world.

Challenges

According to the assessment of MB Securities (MBS), Vietnam needs to increase competition to attract FDI compared to other countries in the region, specifically India and Indonesia. To attract FDI after the pandemic, India has allocated a clean land fund of 460 thousand hectares, investing 1.5 trillion USD in infrastructure, and providing tax exemptions and reductions for new investment projects. Many large FDI enterprises such as Samsung, Apple, Pegatron are increasing their investments in this country. The Compound Annual Growth Rate (CAGR) of FDI into India during the period 2018-2022 reached 9% per year, higher than Vietnam's 4% per year.

Indonesia attracts a lot of FDI due to the development of the electric vehicle battery production and cloud computing sectors. The CAGR of FDI into this country in the past 5 years reached 13% per year. Meanwhile, FDI into Vietnam still focuses on assembling consumer goods and other electronic devices.

The second factor is the risk of power shortages for production during peak seasons. Vietnam's highest available electricity generation capacity is about 43,000 MW, but during peak periods, the highest demand can reach up to 45,500 MW. With high demand growth, Vietnam may face a maximum shortage of nearly 2,500 MW during peak periods in the coming years, especially when the El Nino cycle is forecasted to be longer and stronger. The risk of power shortages affecting production has led some investors to cancel investment plans in Vietnam.

The impact of the Global Minimum Tax. Vietnam has officially implemented a Global Minimum Tax of 15% for multinational corporations since January 1, 2024. Therefore, companies with revenue above 750 million euros that have enjoyed incentives from Vietnam's investment attraction policies must pay additional taxes at the Global Minimum Tax rate of 15%. Thus, Vietnam's investment incentive policies (tax exemptions, reductions) will lose their effectiveness.

To adapt to the Global Minimum Tax, some countries receiving FDI, similar to Vietnam, have introduced coping policies, including provisions for a minimum domestic supplementary tax, to avoid losing revenue from differential taxes.

MBS believes that, besides nullifying the effectiveness of foreign investment incentive policies, applying the Global Minimum Tax will affect the scale of investment, reduce competitiveness in attracting investment, and affect the strategy of attracting investment for advanced technology development.

MBS analysts believe that investment flows tend to shift to secondary markets due to abundant supply and low rental prices.

In addition, the trend of developing green industrial parks to attract FDI in high technology. Traditional industrial parks only have pure manufacturing plants, housing, and other utility services, losing competitiveness.

Developing green industrial parks means participating in cleaner production activities, minimizing negative environmental impacts with the goal of achieving Net Zero Carbon by 2050, which is also a global trend.

According to Ms. Dinh Le Hanh - founder of Dinhle Group, Vietnam is a developing country with a high annual economic growth rate. Therefore, international investors see Vietnam as a very good market, expecting to find profits and invest securely.

The difficult times recently have been a common picture worldwide, with many people losing their jobs and no new job opportunities. Even Americans are struggling to get loans to buy houses due to high interest rates. Therefore, to solve the real estate situation, the capital issue must be addressed.

In 2023, industrial real estate was still a bright spot, with a significant contribution from FDI. However, Vietnam's prioritization policy for foreigners buying real estate is still hesitant, and the mechanism needs to be clarified so that foreigners investing in Vietnam also have housing for peace of mind, Ms. Hanh remarked.

"Overseas Vietnamese, if they want to buy a house in Vietnam, have to rely on their relatives to put the property under their names. Suppose a dispute arises, then they risk losing both the property and the relationship. So, we are making it difficult for ourselves. Why not allow that capital to flow into real estate legally and naturally? Capital from overseas Vietnamese is very important because it's idle money, accumulated from abroad and sent back to the homeland. As for FDI, it's not our capital, it belongs to foreigners, and they can withdraw their investment when they no longer want to invest," stated Ms. Hanh, highlighting the reality.

Foreign investors need clarity, and FDI is also a catalyst for them to move to Vietnam, establish factories, and companies for a long period, and they need accommodation, housing for their experts, and staff when they come to Vietnam. Therefore, the Government needs a comprehensive solution, so that investors see Vietnam as their second homeland and invest with long-term confidence, expanding further. Alongside this, banks need to be transparent and clear to facilitate easier access to capital, Ms. Hanh noted.

Mr. Bui Huu Tai - Deputy General Director of Tan Dong Hiep Investment and Construction Joint Stock Company (investor of Tan Dong Hiep B Industrial Park, Di An, Binh Duong) said it's necessary to keep up with the green trend in the world, especially in industrial parks (IPs).

"Many IP investors are losing orders to overseas due to some foreign factories following the green trend, having green certifications, and when they manufacture, they have tax advantages when exporting to Europe, the US, based on the world's Carbon Agreement," Mr. Tai shared.

Vietnam needs coordination between IP investors, manufacturing factory owners, including the Government, to set a standard for Net Zero carbon, green IPs to compete with foreign countries.

"Traditionally, Vietnam has relied on cheap labor costs, but now with economic development, China has moved away from relying on cheap labor, reaching average labor costs, and China is facing difficulties in production due to high labor costs. Therefore, Vietnam needs to prepare when there is no longer cheap labor costs in the region and prepare to find a new competitive advantage," Mr. Tai said.

Regarding the costs of developing green IPs, Mr. Tai said Tan Dong Hiep is also implementing some green industrial cluster projects outside the northern region and not affecting much on the finances of IP investors.

However, IP investors need to establish relationships, especially to understand what the green direction is, and how to implement the techniques. If they lack experience, they can collaborate with foreign units to learn their implementation techniques. Following the green trend will not increase much cost for IP investors; on the contrary, it brings many advantages.

Regarding the recent increase in IP rental prices, when the supply increases too high causing rental prices to rise, it will affect the choices of FDI enterprises.

However, the rental price only accounts for 50% of the FDI investor's decision-making. The rest depends on the location, trade, logistics. Next is the openness mechanism of the locality, incentives for FDI; finally, the supply source at that IP determines the decision of FDI investors.

According to data from the Ministry of Planning and Investment, by the end of 2023, the whole country had 416 industrial parks (IPs) established, with a natural land area of about 129.9 thousand hectares. The total area of industrial land is about 89.2 thousand hectares, an increase of 1.5% compared to the same period.

The area of leased IPs reached 51.8 thousand hectares, increasing nearly 6%, with an occupancy rate of 58%. Particularly for IPs that have been put into operation, the occupancy rate is over 72%.

In 2023, registered FDI reached USD 36.6 billion and disbursed FDI reached USD 23 billion, an increase of 32% and 3.5% respectively. This is a good growth rate amidst the difficult global economy when many countries tighten monetary policies.

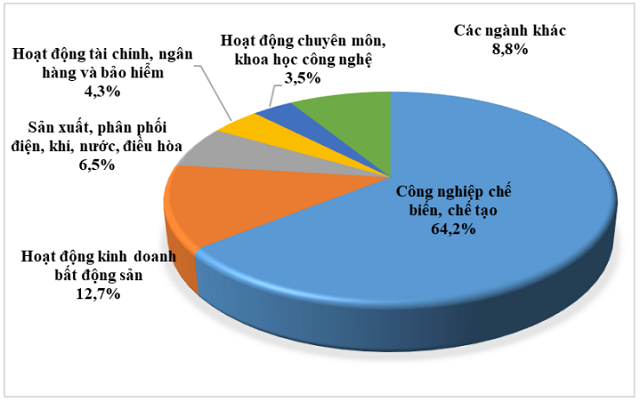

Foreign investment structure in 2023 by sector

Source: Ministry of Planning and Investment

Foreign investors have invested in 18 out of 21 national economic sectors. In which, the manufacturing and processing industry leads with a total investment capital of over USD 23.5 billion, accounting for 64.2% of the total registered capital and increasing nearly 40% compared to the same period. The real estate business sector ranks second with a total investment capital of nearly USD 4.67 billion, accounting for over 12.7%, an increase of nearly 5%.

Via Vietstock