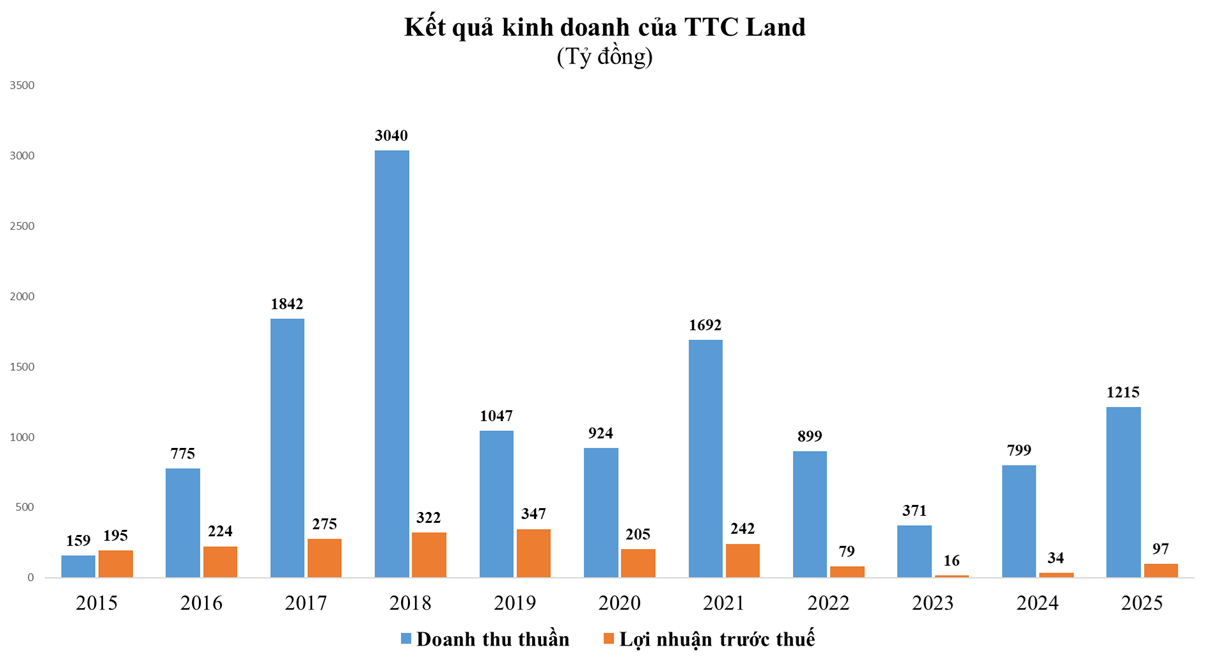

In 2025, TTC Land achieved revenue of VND 1,215 billion, a 52% increase compared to 2024, and after-tax profit of nearly VND 67.4 billion, almost 15 times higher than the same period.

The Q4 2025 financial report of Saigon Thuong Tin Real Estate Joint Stock Company (TTC Land, ticker SCR) recorded net revenue of over VND 264 billion, a 44% decrease compared to the same period in 2024. A significant reduction in cost of goods sold resulted in a gross profit of VND 86 billion, a substantial improvement compared to the VND 102 billion loss in Q4 2024.

During the period, TTC Land's financial revenue decreased by 31% year-on-year to VND 158 billion; while financial expenses increased by 68% to VND 133 billion; selling expenses and administrative expenses increased slightly year-on-year to over VND 28 billion.

As a result, the company reported pre-tax and after-tax profits of VND 34.7 billion and VND 33.5 billion respectively, representing increases of 2.9 times and 12.1 times compared to Q4 of the previous year.

According to TTC Land's explanation, the profit growth in the fourth quarter was mainly due to the expansion of office and factory leasing activities, as well as the strengthening of real estate brokerage and construction activities.

For the full year 2025, TTC Land achieved revenue of VND 1,215 billion, a 52% increase compared to the previous year, mainly due to strong growth in service revenue. Specifically, revenue from real estate services was VND 354 billion, rental services VND 310 billion, construction services VND 326 billion, and merchandise sales VND 155 billion. Conversely, revenue from real estate transfers decreased by 88% compared to the same period, from VND 428 billion to VND 53 billion.

The company's pre-tax profit in 2025 reached nearly VND 97 billion, 2.89 times higher than the previous year, while after- tax profit reached nearly VND 67.4 billion, 14.85 times higher.

In 2025, TTC Land plans for revenue of VND 800 billion and pre-tax profit of VND 50 billion. With the results achieved, the company exceeded its revenue target by nearly 52% and its profit target by 94% for the entire year.

As of December 31, 2025, TTC Land's total assets reached VND 12,912 billion, an increase of VND 1,065 billion, or 8.9%, compared to the beginning of the year. Of this, cash and deposits amounted to VND 449 billion, a 64.4% increase compared to the beginning of the period.

Inventory accounted for the largest proportion of TTC Land's assets, at VND 3,493 billion (27%), followed by short-term receivables at VND 2,811 billion (21.8%), long-term receivables at VND 2,355 billion (18.2%), investment properties at VND 1,558 billion (12.1%), and other items.

Regarding funding sources, by the end of the year, TTC Land's liabilities increased by VND 1,172 billion, equivalent to 18.4%, to VND 7,554 billion. Of this, borrowings accounted for VND 4,185 billion, a 13.8% increase compared to the beginning of the year, including VND 1,323 billion in short-term loans and VND 2,862 billion in long-term loans.

Equity stood at VND 5,357 billion, a slight decrease compared to the beginning of the year. This included owner's contributed capital of VND 4,306 billion, undistributed after-tax profits of nearly VND 470 billion, and a development investment fund of nearly VND 157 billion.

According to Business Life Newspaper