Although the economic performance in the third quarter of 2023 is not exactly positive, a series of securities...

Although the economic performance in the third quarter of 2023 is not exactly positive, a series of securities firms still strongly appreciate industrial real estate stocks thanks to many supporting factors such as: Vietnam is an attractive destination for FDI inflows, limited supply and high demand to help industrial park rental prices remain high...

Industrial real estate stocks have a lot of room for long-term growth. Artwork: Internet.

Industrial real estate stocks have a lot of room for long-term growth. Artwork: Internet.

The momentum of the industrial real estate group is supported by a lot of positive news from recent years. As a result, the market report for the third quarter of 2023 released in November by the Ministry of Construction assesses the positive growth in industrial real estate demand due to the trend of shifting investment flows of multinational companies to Vietnam.

At the same time, accelerated transport infrastructure projects will solve the 'logistics' bottleneck to directly support the industrial real estate sector. Logistics costs in Vietnam account for about 16.8% of the value of goods, while this cost in the world is only about 10.6%. At present, the government is working to improve transport infrastructure with a series of public investment projects aimed at connecting interprovincial traffic and shifting production to non-central provinces such as North-South Expressway, 4th Ring Road - Hanoi, 3rd Ring Road - Ho Chi Minh City. Ho Chi Minh City, as well as seaport and airport projects are being planned and implemented.

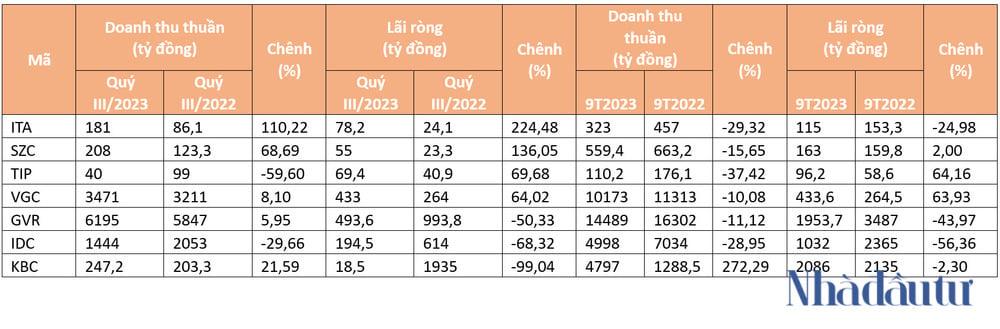

Leading the way in terms of earnings growth in the third quarter of 2023 is Tan Tao Industry and Investment Joint Stock Company (HoSE: ITA). As a result, ITA's net revenue during the period reached VND181 billion, up 110.2 percent from the same period last year.

However, ITA's net profit in the first 9 months of 2023 is only VND113 billion, down 25% over the same period. ITA attributed the decline to the impact of disseminating information about bankruptcy proceedings, although the company did not receive an official message from the court.

There are many factors supporting industrial real estate stocks

Limited supply and high demand are still factors that are helping industrial park rental prices to remain high. and improving transport infrastructure to make industrial areas far from the Central Economic Region more accessible to FDI flows.

Despite the long-term outlook, BSC believes that the industrial real estate sector will have to deal with the problem of continuously increasing rents for industrial parks due to the limited supply of new vehicles. As a result, the shortage of industrial park supply stems from the delay in the implementation of new IPs due to the overlapping legal procedures, the clearing of the site still faces many obstacles and the mechanism of conversion to industrial park land of each type of land is different, which leads to difficulties of implementation.

According to JLL, Vietnam underperforms Thailand, Indonesia or Malaysia in infrastructure, labour productivity and business environment indicators. However, FDI inflows to Vietnam still rank first in the ASEAN region.

Via Bao Nha dau tu