After completing the final procedures at the Vietnam Securities Depository (VSD), GEG is expected to officiall...

After completing the final procedures at the Vietnam Securities Depository (VSD), GEG is expected to officially trade on the HOSE on September 19th, 2019 with the offering price determined to be the average price of last 20 sessions on Upcom. In addition to the reference method P/E with a price of nearly VND 32,000

On August 28th, 2019, Ho Chi Minh City Stock Exchange (HOSE) approved to list more than 203.8 million shares of Gia Lai Electricity Joint Stock Company (Ticker: GEG). On August 30th, 2019, the Hanoi Stock Exchange (HNX) also approved to delist all GEG shares on Upcom. Accordingly, it is expected that September 10th, 2019 will be the last trading day on Upcom and September 11th, 2019 is the official delisting day. After completing the final procedures at the Vietnam Securities Depository (VSD), GEG is expected to officially trade on the HOSE on September 19th, 2019 with the offering price determined to be the average price of last 20 sessions on Upcom. In addition to the reference method P/E with a price of nearly VND 32,000. Based on the average price by the end of September 6th, 2019, the expected price of GEG is about VND 27,566.

GEC conducted its first IPO in July 2010 with relatively moderated chartered capital of VND 262 billion and a portfolio of only 11 hydroelectric plants with a total capacity of 61.6 MW. The year of 2016 was considered an important transition when IFC - International Financial Corporation under the World Bank and Armstrong - A Clean Energy Fund of Singapore officially became strategic shareholder with the corresponding holding ratio of 15.95%. and 20.05% respectively. The two strategic foreign shareholders have supported GEG to achieve initial successes in diversifying the development of renewable energy. On March 21st, 2017, GEG was officially traded on Upcom with price of 20,000 VND. After 8 times of increasing charter capital in 9 years, the Company's current charter capital is VND 2,038 billion.

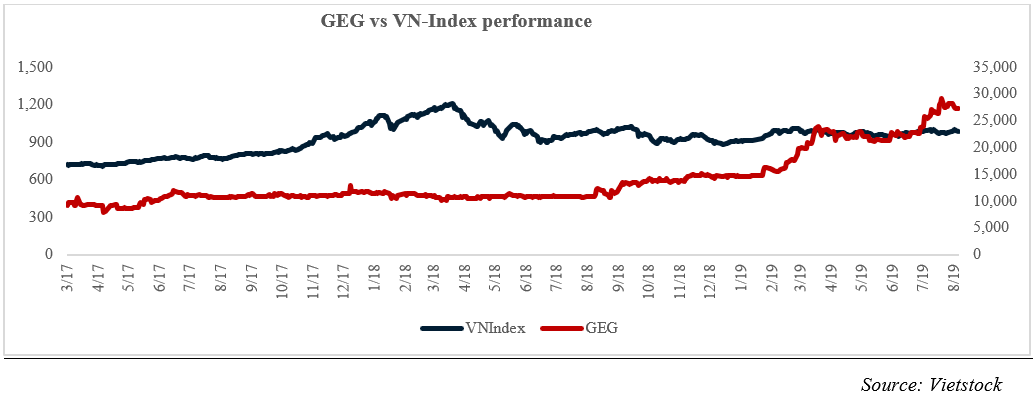

GEG's transactions on Upcom are now very active with an average trading volume of 8 months in 2019 reaching more than 600,000 shares/session compared to just nearly 10,000 shares/session in 2017. Compared to adjusted price of the first day on Upcom, the current price of GEG has tripled, surpassing the increase of VN-Index with just only 37%. As of September 6th, 2019, GEG is trading around 27.000 VND and has increased by 85% since the beginning of 2019, with a market capitalization of USD 240 million. According to the statistics on August 15th , 2019 of SSI, GEG ranked 2nd in the top value of trading in Upcom with sudden increase in trading value compared to the average of 5 sessions, and also in the top 3 Upcom stocks with highest net-buying from foreigner investors , partly showing the potential and prestige of GEG before officially listing on HOSE.

According to the National Assembly's Committee of Science, Technology and Environment, Vietnam has exploited more than 90% of the economic potential of hydropower and this trend tends to decrease. According to EVN, up to now, large hydropower projects with capacity of over 100 MW have been almost fully exploited. Projects with favorable locations and low investment costs have also been implemented. GEC is planning to M&A 2 hydropower projects with a total capacity of 52.5 MW in Hue, with the potential to expand the Hydropower portfolio to nearly 140 MW with 16 plants.

Regarding solar power, in addition to three projects that have connected to the grid this year, GEC plans to increase the solar power capacity by 100 MWp, increasing the capacity of solar power to nearly 400 MWp; especially, optimizing the cooperation in developing solar rooftop with TTC Energy Joint Stock Company (TTCE) - the company specializes in solar rooftop development, through solutions on connection, equipment supply and development of distribution channels.

For the wind power, GEG combines project development from the very beginning as well as looking for M&A projects to save time and diversify the portfolio. In addition to revenue from the electricity business, GEG is also gradually recording revenue from the provision of services such as Operations Management, Engineering, Experiments, O&M, Consulting and Supply of Clean Energy Certificates I -REC for international partners. GEC is contacting and signing 100,000 REC - Renewable Energy certificates from Hydropower and Solar Power projects with international units, bringing added value for investment projects.

On July 15th, 2019, the list of excellent units in the 2018 Annual Report Annual Report (BCTN) system organized by the American Professional Communications Association (LACP) has been announced. LACP has made objective, transparent and in-depth assessments to select the best annual reports. The competition attracted nearly 1,000 large enterprises and organizations from 50 different industries in the world from Energy, Banking, Finance, Consumer, Agriculture, Health, Non-Governmental Services, etc.

GEC, with an equity of about US $ 105 million, at averaged level compared to size of other domestic and international enterprises in Energy Sector, reached an almost absolute score of 97 out of 100. In particular, important information items such as Message to shareholders, Quality of report information, Financial information, Access to information all achieved a maximum score of 10/10.

With the theme of Synchronous development of energy types, the annual report of GEC has won the Silver Prize, ranking third in the Energy Sector after CLP Holdings Limited (Taiwan) and Amprion GmbH (Germany), and is the only company in Vietnam Energy Industry which won an international award. This is an effort of the Company in the process to be more transparency in all business activities, bringing profitability but still associated with economic, social and environmental commitments. In addition to GEC, the other Vietnamese enterprises that won the prizes were HD Bank Platinum Award in the field of Finance - Banking and Bao Viet Group Platinum Award for Finance - Insurance sector.