Along with the positive movement of the stock market in June, SBT stock (Thanh Thanh Cong - Bien Hoa Joint Sto...

Along with the positive movement of the stock market in June, SBT stock (Thanh Thanh Cong - Bien Hoa Joint Stock Company, TTC AgriS) is favored by foreign investors as they continuously increase their ownership percentage.

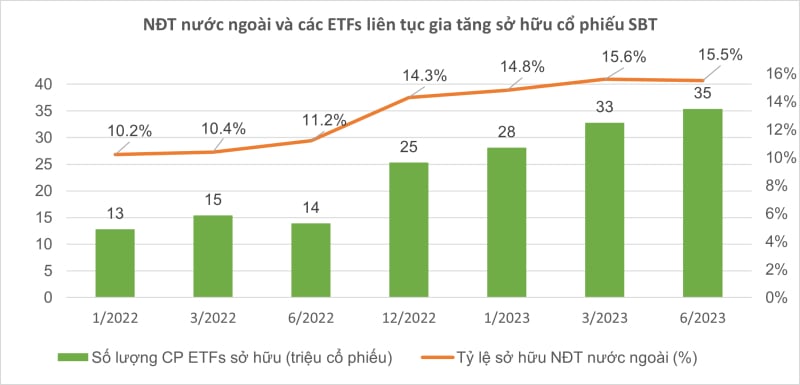

Foreign investors continuously increase the ownership rate of SBT shares

By the end of June 2023, VN-Index increased 45.01 points, equivalent to 4.19% and reached 1,120.18 points, the average trading value per session reached 17,000 billion VND, up 39.7% compared to the previous month and up 77% compared to 5 months ago. At the same time, foreign investors ended the massive sell-off and only saw a net selling of about 364 billion dong in June 2023 on Hose. Regarding matched orders, they recorded net purchases of 368 billion VND.

Contributing to the positive movement of the market, SBT stock of Thanh Thanh Cong - Bien Hoa Joint Stock Company (TTC AgriS, Hose: SBT) continues to be a valuable stock when attracted by many organizations and foreign investors and continuously increase the ownership rate. As of June 30, 2023, the ownership percentage of foreign shareholders in TTC AgriS has continuously recorded strong growth, currently reaching ~ 16%, up 42% compared to the same period in 2022.

At the same time, prestigious domestic and international ETFs have also shown interest by increasing their investments in this stock. Vietnam's stock market currently has 7 ETFs with a size of over 100 million USD including Fubon FTSE Vietnam ETF, DCVFM VNDiamond ETF, iShares MSCI Frontier and Select EM ETF, VNM ETF, DCVFM VN30 ETF, FTSE Vietnam ETF and SSIAM VNFinLead ETF. Accordingly, 3/7 of these ETFs with a size of over 100 million USD are holding SBT shares, of which are Fubon FTSE Vietnam ETF holding ~19 million shares, Vaneck Vietnam ETF with ~9 million shares, iShares MSCI Frontier and Select EM ETF with ~3 million shares,...

As of June 30, 2023, the total number of SBT shares held by these ETFs has reached over 35 million shares, an increase of 154% compared to the same period in 2022. In particular, the Fubon FTSE Vietnam ETF has continuously increased its ownership percentage of SBT, specifically increasing from ~4 million to ~19 million shares, equivalent to a 390% increase compared to the same period in 2021, and increasing from ~6 million to ~19 million shares, equivalent to a 230% increase compared to the same period in 2022.

Source: TTC AgriS

This shows that the cash flow will be concentrated in essential production sectors with good business results and growth prospects, especially companies that meet strict selection standards, have a solid governance framework, and a sustainable development strategy like TTC AgriS.

Creating a circular sustainable agriculture, aiming for Green values is a condition for TTC AgriS to attract foreign capital flows.

To be able to successfully attract and mobilize foreign capital flows over time, TTC AgriS must always strive to improve its governance framework to meet many strict standards, especially from international financial institutions. It is not only necessary for the company to have credibility, strong financial capacity, publicly transparent data, audited by international organizations, feasible capital utilization plans, and professional advisory units, etc. but the capital flow must also serve sustainable development projects and meet ESG standards.

Vice Chairwoman of TTC AgriS Board of Directors - Ms. Dang Huynh Uc My, giving the opening speech at TTC AgriS Innovation Day 2023 with the orientation to focus on sustainable economic and agricultural development

It is known that in the period from 2021-2022, SBT has been in the "Top 20 Sustainable Development Index-listed companies VNSI" for five consecutive years with an ESG score of 96%, continuing to maintain its position as the only Sugar company listed in the VNSI20 index - Top 20 stocks with the highest sustainable development scores in the stock market.

In 2023, TTC AgiS marks an important milestone in transforming its traditional agricultural business management model into an integrated smart agricultural economy model - market-oriented, product-oriented, promoting agricultural economic thinking instead of pure production thinking.

On June 16, 2023, TTC AgriS successfully organized TTC AgriS Innovation Day 2023 with the theme "Serving the best natural nutrition for body needs", officially starting the TTC AgriS Innovation Day event series from 2023, pioneering and leading the sustainable agricultural economy, creating a common playground for science and technology - agriculture economy.

Commitment to sustainable development that TTC AgriS will complete by 2030

Through the achievements gained from efforts in the past years, TTC AgriS aims to continue to lead future agricultural trends in the coming years, such as focusing on developing organic raw material areas, diversifying crop value chains to make the most of raw materials and minimize by-products, aiming for Net Zero in 2035. In which, the "green" business strategy is seen as a driving force for TTC AgriS to maximize profits, contribute to the development of the local economy, contribute to the overall development of the community, and share achievements with related parties, promoting the construction of a sustainable Vietnamese agricultural economy.

According to Young Enterpreneurs Magazine