Many non-public universities have revenues of thousands of billions of dong, including names backed by private enterprises, including listed enterprises.

In mid-May, the Board of Directors of Kinh Bac Urban Development Corporation - JSC (HOSE: KBC) approved the contribution of VND 110 billion to Hung Vuong University Ho Chi Minh City (DHV) to hold 51.79% of capital, putting this 30-year-old university on the list of subsidiaries.

Non-public universities and the trillion-dollar game

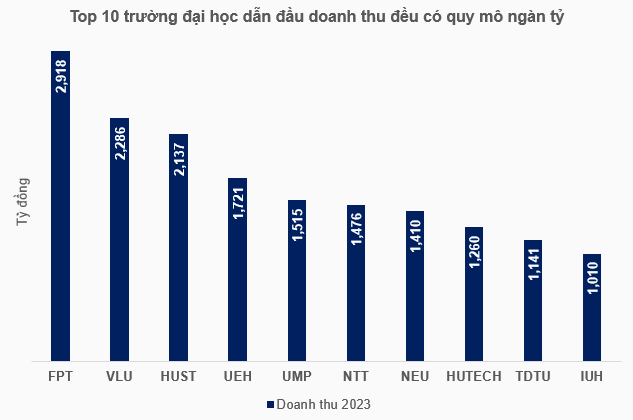

According to the "3 public" reports published by the universities themselves for the 2023-2024 school year, the top 10 schools with the largest revenue in 2023 all have a scale of trillions of VND.

Leading are 3 schools with revenue of over VND 2 trillion, including FPT University with over VND 2,918 billion, Van Lang University (VLU) VND 2,286 billion, and the public school Hanoi University of Science and Technology with VND 2,137 billion.

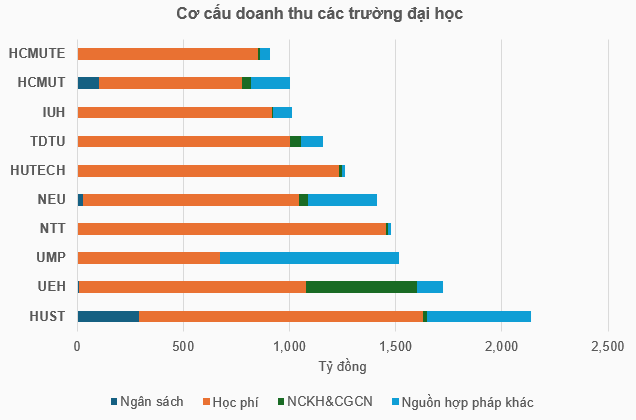

The majority of the schools' revenue comes from tuition fees, the rest from the State Budget (for public schools), scientific research and technology transfer.

Source: Compiled by the writer

Many "bosses" are present on the stock exchange

Leading in revenue, FPT University owned by FPT Corporation (HOSE: FPT) was established in 2006, VLU belongs to Van Lang Education Group, Nguyen Tat Thanh University (NTT) has long been associated with Saigon Textile and Garment Joint Stock Company, or Ho Chi Minh City University of Technology (HUTECH) owned by Hutech Education Development Investment Joint Stock Company.

On the stock exchange, the number of enterprises directly owning universities can be mentioned as VINGROUP Corporation - JSC (HOSE: VIC) owns Vin University (VinUni); FPT Corporation owns FPT University; TTC Group - the owner of TTC AgriS (HOSE: SBT), TTC Hospitality (HOSE: VNG) - invested in Yersin University Dalat (YersinUni), Tan Tao Investment and Industry Corporation (UPCoM: ITA) associated with the image of Tan Tao University.

Or the latest case is Kinh Bac Urban Development Corporation - JSC (HOSE: KBC) invested 110 billion VND to own 51.79% of capital of Hung Vuong University Ho Chi Minh City (DHV). Not only universities, enterprises also invest in an education system across all levels.

On the other hand, there are universities investing in listed enterprises, such as Van Hien University, a major shareholder holding 8.7% of capital (as of March 31, 2025) of Hung Hau Agriculture Corporation (HNX: SJ1) - a member of Hung Hau Holdings. Or businesses divesting from education investments such as Ho Chi Minh City Development Joint Stock Commercial Bank (HOSE: HDB) divesting from its investment in Hoa Binh University in 2024.

Many listed businesses own universities

Investment in schools is highly expected by businesses or leaders. At VinUni, Vingroup recently decided to continue investing up to VND9,300 billion in 2025 and is determined to enter the top 100 universities in the world. VinUni's revenue has also grown strongly in recent years, reaching nearly VND70 billion in 2020, nearly VND106 billion in 2021 and more than VND177 billion in 2022.

In the KBC investment in DHV deal, Mr. Dang Thanh Tam was invited by the Ho Chi Minh City Party Committee to be the sponsor for the school. DHV's business situation has grown in recent years, with revenue of nearly 41 billion VND in 2021, more than 43 billion VND in 2022 and more than 55 billion VND in 2023.

Or Tan Tao University under ITA of Ms. Dang Thi Hoang Yen - Mr. Tam's sister - also recorded growth. Revenue in 2022 reached more than 95 billion VND, an increase of nearly 70% compared to 2021.

In 2022, Tan Tao University also increased its enrollment index by 60% compared to 2021. Then continued to increase the target by 18% in 2023, continued to promote communication activities, organized many activities to promote the image of the University.

On June 15, YersinUni started construction of new classrooms A1, A2 on campus, serving the health, technology, and postgraduate majors, a system of theoretical classrooms, large lecture halls, and admission areas... The project is expected to be completed and put into use from the beginning of the 2026-2027 school year. When TTC Group acquired YersinUni in 2022, Chairman Dang Van Thanh said that the reason for choosing YersinUni to develop the education sector was because Da Lat is favored by nature, with a very cool and mild climate... suitable for studying and gaining knowledge. At the same time, TTC will expand universities in other provinces and cities across the country.

In addition to the stock market, a series of businesses have also invested in the education sector. Nguyen Hoang Group owns a series of universities such as Hong Bang International, Ba Ria - Vung Tau, Gia Dinh, Hoa Sen, Eastern Technology; Hung Hau Holdings owns Van Hien University; Hutech Education Development Investment JSC owns Ho Chi Minh City University of Technology and acquired Ho Chi Minh City University of Economics and Finance; Van Lang Education Group owns Van Lang University and Binh Duong University of Economics and Technology; A&A Green Phoenix JSC (Phenikaa Group) - the parent company of Vicostone JSC (HNX: VCS) - owns Phenikaa University.

Resolution 68 opens up great opportunities for non-public education

The large revenue is proof of the equally attractiveness of non-public universities, demonstrating their role in the higher education system, alongside public institutions.

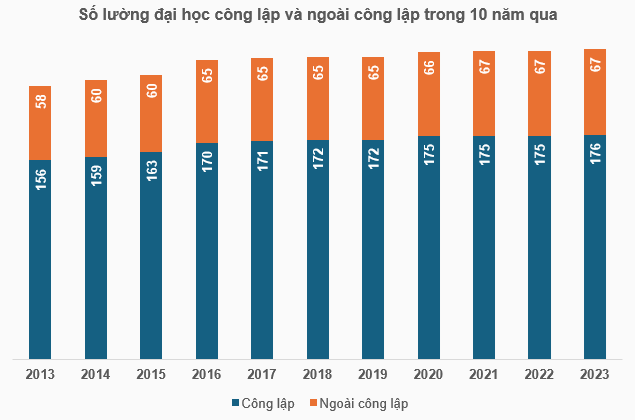

According to data from the Ministry of Education and Training, by the end of 2023, the country had 243 universities, including 176 public schools and 67 non-public schools. Compared to 10 years ago, the number has increased significantly. But the reality is that the period of quantity explosion has passed.

Source: Ministry of Education and Training

However, the picture of the education sector may soon witness a resurgence of non-public schools, following the appearance of Resolution 68 on private economic development.

In 2025, the State will review and eliminate unnecessary business conditions, create an open and transparent policy environment, thereby promoting the private economic sector in general and the vocational education sector in particular.

The Resolution encourages the development of a network of high-quality vocational education institutions, key occupations, promotes international training links and transfers of advanced programs. At the same time, it encourages training according to business orders, allows the cost of training and retraining of human resources to be deducted when determining taxable income for enterprises, and creates incentives for private enterprises to establish or cooperate with vocational education institutions.

In fact, private vocational education institutions can provide human resources equivalent to public institutions without requiring investment from the State budget, while also contributing to taxes and creating jobs. This shows clear socio-economic efficiency, consistent with the policy of strongly developing the private economy.

Perhaps in the future, non-public educational institutions in general and non-public universities in particular, will have many opportunities to develop in both quantity and scale, thereby better meeting the demand for quality human resource training as well as making great contributions to the national economy. However, at that time, non-public schools themselves, or more specifically, the businesses that own them, will have to make great efforts, because the competitive landscape will become increasingly fierce when the "game" is more "open".

According to Finance and Life